We want the best

Together we are PMCH

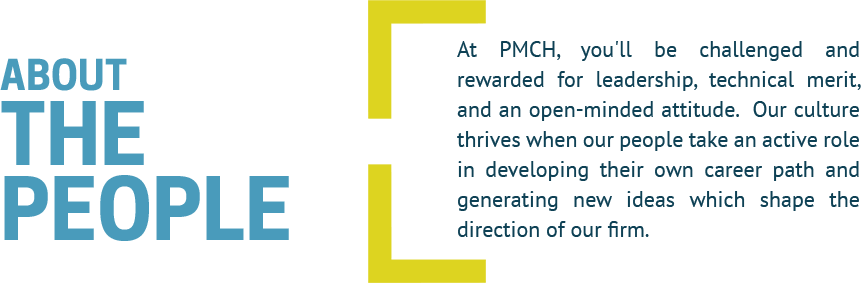

Where you take your career is up to you. At PMCH you can design your career your way. We offer opportunities to build your skills and explore your career in an ongoing learning environment. We believe only you can create your best work life balance.

WHAT WE LOOK FOR

- People with integrity. We want people with a clear sense of personal and professional accountability, who exercise sound judgment and will build their relationships based on doing the right thing.

- People who excel. We want high achievers. We welcome people who think and work analytically and demonstrate leadership characteristics.

- People who communicate. Communication is core to our professional activities. Information gathering, training staff, client discussions can only be successful if our team is committed to clear, simple communication.

- People who demonstrate respect. We look for people who recognize the value of different backgrounds, perspectives and experiences. By respecting these differences we enrich our team and enhance the services we provide to our clients.

WHAT WE LOOK FOR

- Top notch communication skills including both speaking and writing skills.

- Accountant should have a good grasp of current technology and be open to change in this ever-changing technology environment.

- Accountant that has a strong desire to continue their education and pass the CPA exam.

- Accountant with a Master or Bachelor Degree and who has passed the CPA exam.

- PMCH employees may be expected to work extended hours during certain times of the year.

JOB OPENINGS

Porter, Muirhead, Cornia & Howard (PMCH) in Casper, Wyoming is a premier certified public accounting firm and tax smart wealth advisors providing outstanding professional services for our clients, rewarding careers for our staff, and diligent service to our communities.

Are you looking for an opportunity to advance your career in accounting? Would you like to be a part of a growing firm that encourages a collaborative culture and values a work-life balance for its employees? If so, please read on!

At PMCH, we care about people – our clients, our employees, and our community. We listen, research, advise, and implement personalized accounting solutions to guide our clients down a path that will help them succeed in today’s complex economic environment. Our professionals provide individuals, businesses, and nonprofits with personal service, education, and knowledge that help our clients make sound decisions as well as get the most out of the work we do for them. We always work hard to do what is best for our clients, colleagues, and the communities we serve.

At our company, it is the people working for us who make a difference. No matter what stage an employee is at in their career, we are invested in helping them along their career path by offering exciting challenges. Our employees also enjoy upward advancement, flexibility in work schedules, and strong relationships with a team that really cares about them and their success.

A DAY IN THE LIFE OF A STAFF ACCOUNTANT

• Perform basic auditing procedures, such as cash, investments, payables, fixed assets, debt, and compliance.

• Prepare basic financial statements using appropriate software.

• Prepare workpapers with use and explanation of tick marks and cross-referencing. Prepare memos to document audit procedures.

• Prepare individual and entity tax returns.

• Efficiently complete audit programs, checklists, and workpapers without over-auditing.

• Review internal controls and offer methods for improvement when deficiencies are found.

• Write audit letters, including drafting management letter comments.

QUALIFICATIONS FOR A STAFF ACCOUNTANT

• Bachelor’s Degree in Accounting

• Eligibility to sit for CPA exam or working toward CPA is highly desired

• Prior internship experience would be fantastic

• Knowledge of general ledger accounting software

• Understanding of GAAP

• Demonstrated ability to relate well to clients

• Applicants must be currently authorized to work in the United States on a full-time basis

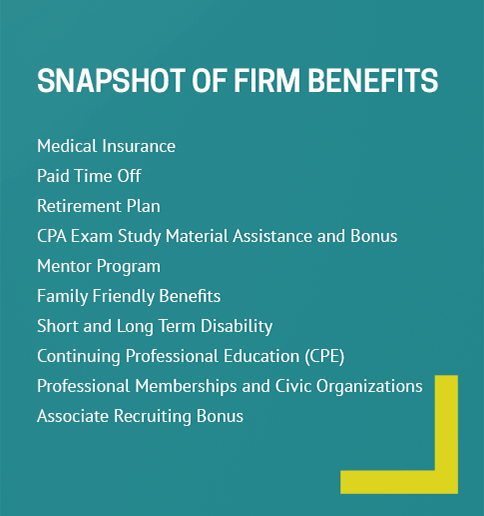

Benefits & Compensation

PMCH provides a competitive compensation package commensurate with qualifications and experience as well as significant opportunities for advancement. We also offer a comprehensive benefits program including paid health insurance, paid short-term and long-term disability, PTO, 401k, and professional education.

Porter, Muirhead, Cornia & Howard (PMCH) in Casper, Wyoming is a premier certified public accounting firm and tax smart wealth advisors providing outstanding professional services for our clients, rewarding careers for our staff, and diligent service to our communities.

Are you looking for an opportunity to advance your career in accounting? Would you like to be a part of a growing firm that encourages a collaborative culture and values a work-life balance for its employees? If so, please read on!

At PMCH, we care about people – our clients, our employees, and our community. We listen, research, advise, and implement personalized accounting solutions to guide our clients down a path that will help them succeed in today’s complex economic environment. Our professionals provide individuals, businesses, and nonprofits with personal service, education, and knowledge that help our clients make sound decisions as well as get the most out of the work we do for them. We always work hard to do what is best for our clients, colleagues, and the communities we serve.

At our company, it is the people working for us who make a difference. No matter what stage an employee is at in their career, we are invested in helping them along their career path by offering exciting challenges. Our employees also enjoy upward advancement, flexibility in work schedules, and strong relationships with a team that really cares about them and their success.

A DAY IN THE LIFE OF A TAX MANAGER

• Manage the preparation and first review of high-level return.

• Work with staff to ensure individual and business tax returns are completed correctly and by the required deadline.

• Review, approve, and sign tax returns for release to clients.

• Coach or mentor a staff member to assist with enhancing their skills and further developing their career.

• Gather relevant tax-related information from the client so an accurate tax return can be prepared.

• Look at tax situations from various angles to ensure the maximum tax benefit is applied.

• Network, build relationships, and attract new clients or business for the Firm.

• Bill clients for the services and guidance provided.

QUALIFICATIONS FOR A TAX MANAGER

• Bachelor’s degree in Accounting

• CPA licensed

• Proven work experience

• Strong skills in Microsoft Office Suite products

• Quickly adaptable to changing work requirements and assigned projects

• Excellent analytical and problem solving abilities and attention to detail

• Demonstrate strong interpersonal skills and work ethic

• Demonstrate strong verbal and written communication skills

• Demonstrate strong ability to manage multiple projects and meet deadlines

• Demonstrate flexibility to work additional hours as needed

• Dedication to teamwork and excellent leadership skills

• Applicants must be currently authorized to work in the United States on a full-time basis

• Build relationships and interact with clients to provide excellent planning, consulting and expertise

• Improve processes by developing or implementing best practices

• Willing to self-develop to progress your career

Our ideal candidate is someone who enjoys developing lasting relationships with our clients so that they will entertain candid conversations about their life and businesses; by having a better understanding of who they are and what they do, we can produce a high-quality tax return and provide them with the most appropriate tax planning advice. We are looking for a ‘hands on’ individual in both work style and client relationship skills; someone who is also passionate about developing the people on the team and values an environment where people strive to consistently grow.

Benefits & Compensation

PMCH provides a competitive compensation package commensurate with qualifications and experience as well as significant opportunities for advancement. We also offer a comprehensive benefits program including paid health insurance, paid short-term and long-term disability, PTO, 401k, and professional education.

Porter, Muirhead, Cornia & Howard (PMCH) in Casper, Wyoming is a premier certified public accounting firm and tax smart wealth advisors providing outstanding professional services for our clients, rewarding careers for our staff, and diligent service to our communities.

Are you looking for an opportunity to advance your career in accounting? Would you like to be a part of a growing firm that encourages a collaborative culture and values a work-life balance for its employees? If so, please read on!

At PMCH, we care about people – our clients, our employees, and our community. We listen, research, advise, and implement personalized accounting solutions to guide our clients down a path that will help them succeed in today’s complex economic environment. Our professionals provide individuals, businesses, and nonprofits with personal service, education, and knowledge that help our clients make sound decisions as well as get the most out of the work we do for them. We always work hard to do what is best for our clients, colleagues, and the communities we serve.

At our company, it is the people working for us who make a difference. No matter what stage an employee is at in their career, we are invested in helping them along their career path by offering exciting challenges. Our employees also enjoy upward advancement, flexibility in work schedules, and strong relationships with a team that really cares about them and their success.

A DAY IN THE LIFE OF AN AUDIT MANAGER

• Manage external audit engagements including client expectations, budgets and financial reporting

• Deliver detailed analysis of findings and coordinate all analytical, technical and research tasks

• Collaborate with Managers and Shareholders in the areas of risk assessment, audit plan programs and internal audit reports

• Review work prepared by the staff and seniors and provide constructive feedback to develop their personal and professional skills

• Build relationships with existing clients, including involvement in networking and business development activities

• Develop, train and mentor Interns, Associates and Seniors on projects and assess both personal and professional performance for engagement and career development opportunities

• Attend professional development, networking events and training seminars on a regular basis

QUALIFICATIONS FOR AN AUDIT MANAGER

• Bachelor’s degree in Accounting

• CPA licensed

• Proven work experience

• Strong skills in Microsoft Office Suite products

• Quickly adaptable to changing work requirements and assigned projects

• Excellent analytical and problem solving abilities and attention to detail

• Demonstrate strong interpersonal skills and work ethic

• Demonstrate strong verbal and written communication skills

• Demonstrate strong ability to manage multiple projects and meet deadlines

• Demonstrate flexibility to work additional hours as needed

• Dedication to teamwork and excellent leadership skills

• Applicants must be currently authorized to work in the United States on a full-time basis

• Build relationships and interact with clients to provide excellent planning, consulting and expertise

• Improve processes by developing or implementing best practices

• Willing to self-develop to progress your career

Benefits & Compensation

PMCH provides a competitive compensation package commensurate with qualifications and experience as well as significant opportunities for advancement. We also offer a comprehensive benefits program including paid health insurance, paid short-term and long-term disability, PTO, 401k, and professional education.

join our team. submit your resume.

internship program

- The primary purpose of our internship program is to help students determine if public accounting is for them. This often includes full participation in accounting tasks given to first year staff. There are also opportunities to attend numerous social and community events; receive training, feedback and evaluation of work performed.

- PMCH's paid internship program immerses students into the profession, firm and Wyoming. Our real-world approach centers around treating interns as staff members and offers the tools, training and experience to achieve rapid professional growth from the beginning.

- On-boarding begins with a trainer to learn about our software and processes. Trainers provide insight into the firm and the profession.

- Summer internship typically runs June through August and centers around auditing. Winter internship typically runs January through April and centers around tax.

QUALIFICATIONS

- Candidates who have completed their junior year. Summer interns must have finished their auditing course work.

- Flexibility to travel to client locations with an overnight stay, if needed.

- Proficiency with Microsoft Word, Excel and Adobe Acrobat.

- Demonstrate strong interpersonal skills and work ethic.

- Demonstrate strong verbal and written communication skills.

- Applicants must be currently authorized to work in the United States on a full-time basis.

Let’s start a conversation about your goals and how we can help. Please call our office or send a message using the contact form on the right.

If you are interested in a career with us, please visit the careers section of our website.

INFORMATION

Casper Office

600 East 1st Street

Casper, WY 82601

Firm Permit # 151

Mailing Address: PO Box 2750 Casper, WY 82602

Montana Office

1716 W Main St Ste. 5

Bozeman, MT 59715

Firm Permit # PAC-FIRM-LIC-55605

307.265.4311